| The Job Support Scheme (JSS) provides different types of support to businesses so they can get the assistance according to their situation. Businesses that are open but facing decreased demand can get support for wages through “JSS Open”. Those businesses that are legally required to close their premises as a result of coronavirus restrictions set by one or more of the four governments of the UK, can get the support through “JSS Closed”.

The JSS starts on the 1 November 2020 and runs for 6 months, until 30 April 2021. The government will review the terms of the scheme in January. Employers will be able to claim in arrears from 8 December 2020, with payments made after the claim has been approved. Neither the employer nor the employee needs to have benefitted from the Coronavirus Job Retention Scheme to be eligible for the Job Support Scheme.

From 8 December, employers will be able to claim salary for pay periods ending and paid in November. Subsequent months will follow a similar pattern, with the final claims for April being made from early May.

Further guidance on the steps that employers need to take to calculate and make a claim to the Job Support Scheme will be published by the end of October. We will update you when the information is made available.

How will the JSS scheme work and who is eligible?

An employer can claim the JSS Open and JSS Closed grant at the same time for different employees, however, an employer cannot claim for a single employee under both schemes at the same time.

Employers will be able to access the Job Support Scheme if they have enrolled for PAYE online and they have a UK, Channel Island or Isle of Man bank account.

Additional eligibility criteria will apply depending on whether the employer is claiming a JSS Open grant or JSS Closed grant.

Eligible employers will be able to claim the Job Support Scheme grant for employees who were on their PAYE payroll between 6 April 2019 and 23 September 2020.

1. Employers facing decreased demand (JSS Open)

For businesses facing reduced demand the JSS Open scheme will give employers the option of keeping their employees in a job on shorter hours rather than making them redundant.

The government has announced that it will increase the scale of support available to employers through JSS Open above what was initially announced, in order to protect more jobs.

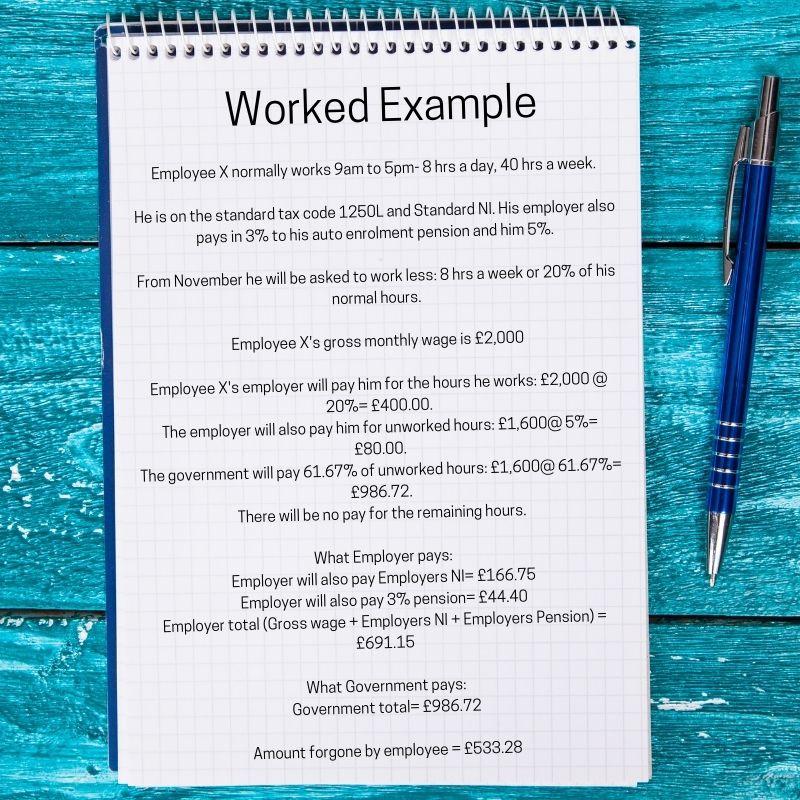

The employee will need to work a minimum of 20% of their usual hours and the employer will continue to pay them as normal for the hours worked. Alongside this, the employee will receive 66.67% of their normal pay for the hours not worked – this will be made up of contributions from the employer and from the government. The employer will pay 5% of reference salary for the hours not worked, up to a maximum of £125 per month, with the discretion to pay more than this if they wish. The government will pay the remainder of 61.67%, of reference salary for the hours not worked, up to a maximum of £1,541.75 per month. This will ensure employees continue to receive at least 73% of their normal wages, where they earn £3,125 a month or less.

2. Employers who are legally required to close their premises (JSS Closed)

Employers who have been legally required to close their premises as a direct result of coronavirus restrictions set by one or more of the four governments of the UK are eligible for JSS Closed.

This includes premises restricted to delivery or collection only services from their premises and those restricted to provision of food and/or drink outdoors.

Businesses premises required to close by local public health authorities as a result of specific workplace outbreaks are not eligible for this scheme.

Employers are only eligible to claim for periods during which the relevant coronavirus restrictions are in place. Employers will not be able to claim JSS Closed to cover periods after restrictions have lifted and the business premises are legally allowed to reopen. They may then be able to claim JSS Open if they are eligible.

Each employee who cannot work due to these restrictions will receive two thirds of their normal pay, paid by their employer and fully funded by the government, to a maximum of £2,083.33 per month, although their employer has discretion to pay more than this if they wish.

Eligible employers will be able to claim the JSS Closed grant for employees:

• whose primary workplace is at the premises that have been legally required to close as a direct result of coronavirus restrictions set by one or more of the four governments of the UK

• that the employer has instructed to and who cease work for a minimum period of at least 7 consecutive calendar days |